Economic Architecture for the Caribbean, with SourceEnergy Group

BY EVERWILD1

Creating an Economic Architecture for the Caribbean region, incorporating the four components of SourceEnergy Group at its core, involves envisioning a structure that leverages the unique characteristics of Dominican Republic, Haiti, Cuba, and Jamaica, as well as the broader CARICOM and CAFTA-DR regions. This architecture will also consider the impact on and from international entities like the Development Finance Corporation (DFC) and the Export-Import Bank (Exim).

1. Quark Trio – Dominican Republic, Haiti, Cuba: The Foundation

- Dominican Republic (Up Quark): Focus on expanding the tourism-driven economy to include sustainable tourism, attracting investment in eco-friendly resorts, and leveraging its growth for regional economic spillovers.

- Haiti (Down Quark): Implement resilience-building projects supported by SourceEnergy Foundation. Focus on educational initiatives and infrastructure development, tapping into potential growth sectors like agriculture and digital services.

- Cuba (Down Quark): Encourage gradual economic opening and reforms, focusing on healthcare, biotechnology, and cultural industries. SourceEnergy Capital can play a role in funding and advising on market reforms and international trade integration.

2. Jamaica (Electron) – The Dynamic Catalyst

- Jamaica as the Economic Electron: Position Jamaica as a hub for cultural exchange, technological innovation, and regional leadership in energy transformation. Jamaica’s dynamic economy could be further boosted by investments from SourceEnergy Capital in renewable energy projects and technology startups.

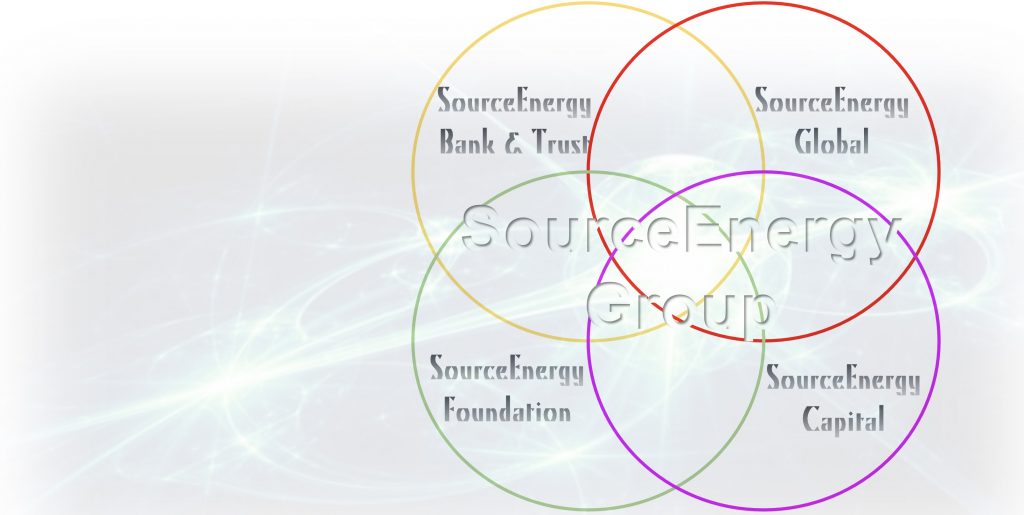

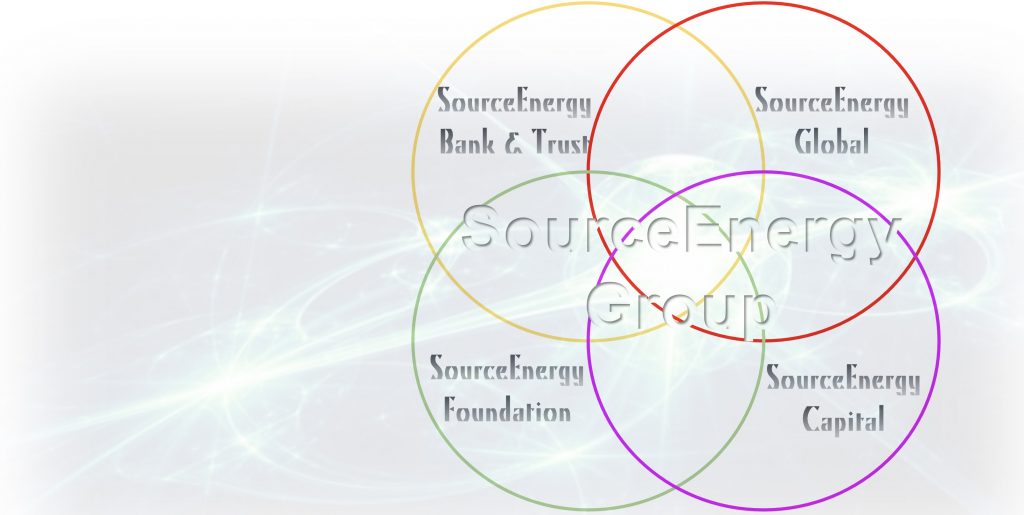

3. SourceEnergy Group: The Core Integrator

- SourceEnergy Capital: Invest in and finance key projects across the region, focusing on sustainable energy, infrastructure, and technology, aligning with each nation’s strengths and needs.

- SourceEnergy Bank & Trust: Provide financial services that support regional trade and investment, facilitate cross-border transactions, and offer financial products tailored to Caribbean economies.

- SourceEnergy Global: Engage in large-scale infrastructure projects, especially in renewable energy, to foster regional energy independence and integration.

- SourceEnergy Foundation: Support educational and community development initiatives, particularly in less-developed areas, focusing on building resilience and capacity.

4. Impact on CARICOM and CAFTA-DR, and Interaction with DFC and Exim

- CARICOM and CAFTA-DR: Enhance economic cooperation and integration within these frameworks. The economic architecture should support free trade agreements, regional supply chain development, and unified strategies for tourism and export diversification.

- Engagement with DFC and Exim: Leverage funding and investment opportunities from these institutions for regional projects. Focus on attracting financing for large-scale infrastructure, energy projects, and export-oriented industries.

- Promoting Regional Stability and Growth: The architecture should aim to balance development, address disparities among nations, and promote overall regional stability and growth.

In summary, this Economic Architecture for the Caribbean, with SourceEnergy Group at its core, aims to integrate and elevate the region’s economies, leveraging each nation’s unique strengths, fostering regional cooperation, and drawing on international partnerships and investments for sustainable development and growth.

The Caribbean Basin Initiative (CBI)

Our Caribbean Basin Initiative (CBI)1, with its focus on fostering economic development and stability in Caribbean Basin economies, provides an avenue for the application of the Wealth Ecology Model (WEM) in a strategic and impactful way. Considering the CBI’s framework, here’s how the WEM principles could be integrated:

- Modular Economic Growth and Diversification: Using WEM’s modular approach, target specific sectors in each beneficiary country for development. Focus on areas where these countries have comparative advantages, like agriculture, tourism, renewable energy, and digital services. Each sector’s development can be treated as a module in the broader economic plan.

- Sustainable Development and Environmental Stewardship: Align CBI’s economic objectives with sustainable practices. Encourage investment in green technologies and eco-friendly practices in industries, particularly in sectors like tourism which are crucial for many Caribbean economies.

- Leveraging Technology for Market Access: Promote the use of technology to enable Caribbean Basin countries to access the U.S. market more effectively. This could involve e-commerce platforms, digital marketing strategies, and logistics technology to streamline the export process.

- Inclusive Growth and Community Participation: Ensure that the economic benefits from CBI reach a broad base of the population. This could involve supporting small and medium enterprises (SMEs), community-based tourism projects, and local agricultural initiatives.

- Capacity Building and Human Capital Development: Utilize CBI programs to enhance skills and capacities that are crucial for the modern economy. This includes vocational training, digital literacy programs, and educational initiatives that align with market demands.

- Resilient Economic Structures: Strengthen economic resilience against external shocks such as natural disasters and global market fluctuations. This could involve diversifying economies, building stronger local supply chains, and investing in disaster risk reduction and management.

- Regional Cooperation and Integration: Foster deeper economic integration among CBI countries through joint ventures, regional supply chains, and collaborative projects. This could enhance the collective bargaining power and market presence of these countries.

- Customized Strategies for Each Country: Recognize the unique economic profiles of each beneficiary country and tailor the CBI programs accordingly. For instance, focus on tech and innovation in countries with a strong IT base, or on agricultural modernization in countries with rich agricultural potential.

By integrating these strategies within the CBI framework, the Wealth Ecology Model can significantly contribute to the holistic and sustainable development of the Caribbean Basin economies, aligning with both the CBI’s goals and the WEM’s principles.

- The CBI was launched in 1983 through the Caribbean Basin Economic Recovery Act (CBERA) and expanded in 2000 by the U.S.-Caribbean Basin Trade Partnership Act (CBTPA) and again by the in the Trade Act of 2002. CBERA was implemented on January 1, 1984 and has no set expiration date. The CBTPA is scheduled to expire on September 30, 2030.

There are 17 CBERA beneficiary countries: • Antigua and Barbuda • Aruba • The Bahamas • Barbados • Belize • British Virgin Islands • Curacao • Dominica • Grenada • Guyana • Haiti • Jamaica • Montserrat • St. Kitts and Nevis • St. Lucia • St. Vincent and the Grenadines • Trinidad and Tobago Eight of these 17 are also beneficiaries under CBTPA: • Barbados • Belize • Curacao • Guyana • Haiti • Jamaica • St. Lucia • Trinidad and Tobago ↩︎